Real Estate

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Real Estate Sector

The Real Estate sector is the continuous evolution of the Real Estate industry, in its various forms and facets, and represents the strongest and most important market in terms of turnover, Assets and number of stakeholders. Due to its relevance and the multiple investment opportunities it offers, WeInvest has created a specific Sectorial Thematic Club Deal for it.

This market sector encompasses real properties in a broad sense, such as lands, buildings, property rights, etc. These properties are diversified into various sub-sectors. Specifically, the types of properties that can be subject to investment opportunities are assets serving various functions, including residential, commercial, industrial, tourism, etc.

Internationally, the Real Estate Sector is a critical engine and an important indicator from an economic standpoint. For this reason, investors and analysts constantly monitor its trends to understand the overall direction and economic development of individual Countries.

Sector Charateristics

Business Model

Here are different functions for the types of Properties that can represent an investment opportunity. The Assets are classified as follows:

- residential, properties used for residential purposes, including single-family homes, condominiums, cooperatives, duplexes, townhouses and multifamily residences;

- industrial, any property used for manufacturing, production, distribution, storage, research and development purposes;

- commercial, properties used exclusively for commercial purposes, such as gas stations, grocery stores, hospitals, hotels and other non-hotel accommodations, offices, parking lots, bars and restaurants, shopping malls, theatres and various retail spaces;

- land, undeveloped properties, including vacant land and agricultural land (farms, orchards, ranches, forests, etc.);

- special purpose, typically, properties used for public purposes, such as government buildings, libraries, parks, cemeteries, places of worship and schools.

In the Real Estate Sector, there are also different Business Models, such as:

- Real Estate Development

- Real Estate Management

- Real Estate Advisor

- Asset Management

- Real Estate Efficiency

Status

The performance of the Real Estate sector is widely influenced by a series of factors, such as location (city, area, neighbourhood, etc.), occupancy rates, local economy, crime rates, infrastructure and transportation services, quality of life, public administration services, etc. These factors can increase or decrease the real value of Real Estate Assets. Typically, the Real Estate sector is considered pro-cyclical (from the perspective of builders) and less cyclical (from the perspective of suppliers). In general, it is a rapidly evolving and highly developed sector, thanks in part to its interdependence with other (related and unrelated) market sectors. This evolution is mainly attributed to the advancement of the technology sector.

Typically, the Real Estate sector is illiquid and the trend is to diversify one's investment portfolio to achieve a steady income.

Market Risks

There are several Market Risks associated with the Real Estate sector in terms of investment opportunities. Among the main risks, mostly related to contextual macro-factors (PEST factors - political, economic, social, technological), we find:

- Slowdown in post Covid-19 recovery, both in the specific sector and the overall economy;

- Potential Global recession (2022-23), primarily due to the European-Russian-Ukrainian conflict and the subsequent collapse of the energy sector, leading to increased interest rates and costs for the acquisition of various raw materials;

- Risks of political instability, both at the national and international levels;

- Connection and dependence on the economic context;

- Influenced by highly localised factors.

Market Trends

Among the main trends characterising the Real Estate sector, we have:

- Digital Transformation, with a particular focus on the Metaverse, which is driving an increasing willingness to invest in the virtual real estate market, primarily with the sale of commercial properties;

- Suburban boom, following the Covid-19 emergency, there has been a new market demand that has led a significant portion of the population to prefer purchasing residential properties in suburban areas, with more outdoor spaces, as opposed to apartments in urban areas;

- Great Resignation, this term refers to the phenomenon of employees leaving their jobs, mainly due to the pandemic emergency and the growing preference for remote work. This has led to a redesign of workspaces (offices) with a reduction in average size, emphasising both technological amenities and the creation of co-working areas;

- Investments in the residential sector, this increase has also been fuelled by the decree “Rilancio 2020," which introduced several incentives for condominiums and housing, such as the Superbonus 110%, Ecobonus, Water Bonus, Furniture Bonus, 50% Renovation Bonus, First Home Bonus, etc.

- Wellness Real Estate, in recent years, the real estate market has become closely linked to the luxury market, creating new usage destinations and market opportunities. The concept of "wellness at home" has emerged, representing a convergence between wellness and the real estate sector, resulting in a growing demand for buildings that positively impact the holistic health and well-being of people living and working inside them.

Market Values

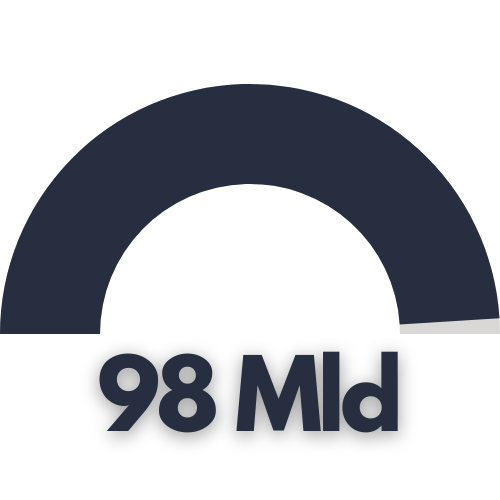

Investments (in €, 2020)

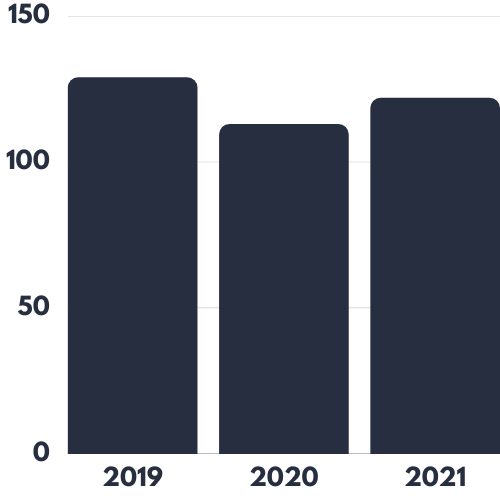

Revenue Trend (in Billion of €)

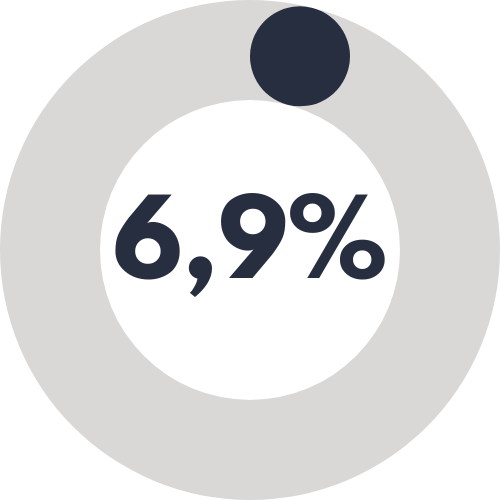

Contribution % to GDP (Italy, 2021)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.