Media & Entertainment

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Entertainment Sector

Digital Media, Film, Interactive & Mobile, Music, Video-games & eSports, Print, Publishing & eBooks, Streaming, Television, Advertising... are just a few areas within the broader Media & Entertainment sector.

It is a market sector that involves private companies, public entities and/or non-profit organizations whose economic activities are based on information, communication (including advertising) and/or pure entertainment. The Media and Entertainment industry consists of diverse companies that offer services and products including films, TV programs, news, music, books, advertising, etc.

According to the analyst at Market Research Future, the global Entertainment and Media market is projected to expand at a CAGR of 8.6% by 2030. For this reason, WeInvest has decided to dedicate a specific Sectorial Thematic Club Deal to M&E.

Sector Characteristics

Business Model

The M&E industry is composed of companies that produce, distribute and offer a wide range of predominantly digital services and products. These companies operate within various sub-sectors, including:

- Television

- Cinematic

- Radio

- Print and Publishing

- Recording Industry

- Digital Media

- Communication and Advertising Agencies

- Videogames

Most, if not all, of these sub-sectors are characterised as two-sided or multi-sided markets. They are platforms or markets that provide products and services to meet the needs of two different market demands. Typically, one side represents the end consumers, while the other side is made up of advertising clients. In this market model, companies operating in these sectors can generate value and profit from both sides or choose to focus on one over the other.

Status

Like many other market sectors, the Entertainment industry is highly cyclical. This cyclical nature was evident during the 2020-2021 period amidst the COVID-19 pandemic. The industry experienced a slowdown in production and revenue, mirroring the overall economic halt. Furthermore, due to the high level of interaction and collaboration involved in this sector, there was a greater sectoral disruption compared to primary sectors.

The industry is characterised by high levels of diversification and differentiation. It is projected to have a global growth rate of 8.6% by 2030, with the North American region being the dominant player, already established as the most powerful and robust market segment. Additionally, it is worth noting that the industry is strongly influenced and "controlled" by Over The Top (OTT) operators, such as: Netflix, Amazon, Google, Meta, Disney, etc.

Market Risks

Given that the Media and Entertainment sector is vast and involves multiple stakeholders throughout its production chain, it is important to carefully evaluate the associated risks before making investments in this industry. Among the key risks are:

- Uncertainty regarding the revenue of the final product following a significant investment. This occurs, for example, in film productions where the promoting entities involved have no guarantees or certainties about the economic outcomes of the product once it is finished and released on the market;

- PEST events (politici, economici, sociali e tecnologici), have a significant influence on the economic results related to this sector. Consumer habits, which encompass socio-cultural behaviours of the audience consuming various multimedia products (films, music, video games, etc.) and the methods and technologies used to consume them (such as the use of 3D and 4D technologies in films) can greatly affect the sector's outcomes.

Market Trends

There are several new market trends associated with the M&E sector, including::

- Personalization of the offerings, this involves customising multimedia products and advertising through the use of innovative technologies such as Addressable TV (ATV) and Programmatic Advertising;

- Increased adoption of mobile devices (smartphones) that offer greater accessibility and ease of consuming multimedia products;

- Digital Transformation, the digital sector prevails in the M&E industry, with increased streaming services compared to traditional entertainment. Virtual Reality (VR) is also a growing segment;

- Expansion and growing popularity of the Gaming & eSports sector, this sector is no longer limited to video game enthusiasts but also attracts audiences of films and TV series. It provides active engagement rather than passive consumption for viewers;

- Podcasts experiencing grater growth, in the audio product segment.

Market Values

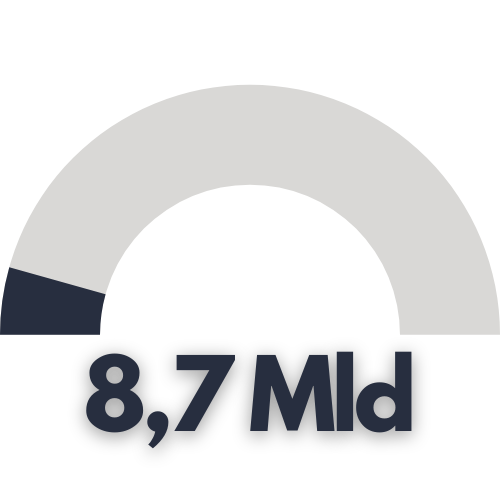

Investments (in €, 2021)

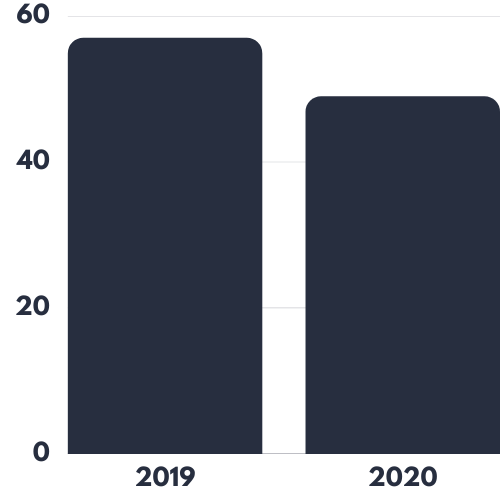

Revenue Trends (in Mld di €)

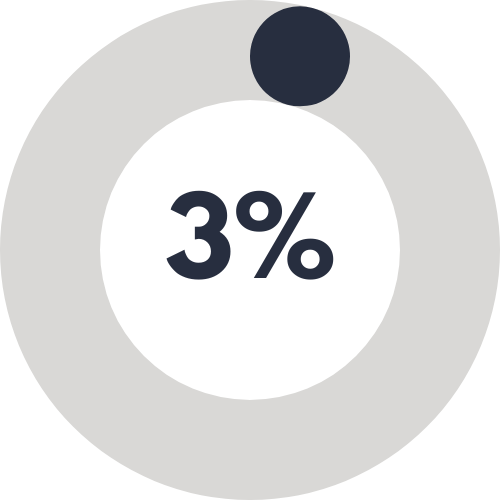

Contribution % to GDP (Italy, 2021)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.