Circular Economy

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Circular Economy Sector

The market sector is based on an economic model that goes beyond the concept of end-of-life for goods to preserve the value of materials for as long as possible, reducing the use of raw materials and non-renewable energy and generating value from every waste. The goal is to achieve sustainable development that involves creating environmental quality, economic prosperity and social equity. Investments in this type of sector are included in the Best Practices of Environmental, Social & Governance (ESG).

The Circular Economy is a zero-waste economy where any product should be consumed and disposed of without leaving a trace. Of particular relevance are the modularity and versatility of objects, which can and should be used in various contexts to maximise their value for as long as possible. Due to its relevance and influence on multiple market businesses, WeInvest has chosen to dedicate a specific Sectorial Thematic Club Deal to the Circular Economy.

The idea of developing the Circular Economy can push and guide the entire economic system towards new behavioural models. This highlights 3 different aspects: closing resource loops, slowing down the usage cycles and narrowing the resource usage circuit.

Sector Characteristics

Business Model

Circular business models are the key to extending the life of many National and International businesses. It starts with general categories that provide an overview of actions to be taken for one's own business and effectively communicating them to the public. Then, attention is directed towards more specific aspects based on the activity and processes carried out by each individual company:

- Product as a Service, which focuses on the use of the product rather than its ownership;

- Regeneration, involving the actual re-manufacturing process carried out in material regeneration factories;

- Upcycling, which creates new material cycles and adds value to production waste without energy loss;

- Life Extension, which offers products with an extended lifespan at a higher price.

Some typical examples of businesses in the Circular Economy include:

- Producing fabrics from orange processing waste;

- Establishing a biogas plant using agricultural and food production residues;

- Recycling used tires using microwave technology;

- Reusing materials through the return of used furniture or clothing;

- Recycling plastic to create new materials.

Status

The principles of Circularity and Sustainability have an impact on all different market businesses today and every company, regardless of its position in the value chain, must integrate these principles. This applies from design and production to the consumption by the end customer. Since the Circular Economy is a multi-sector phenomenon, stakeholders of all kinds are involved. The sectors that are currently more circular includeo:

- Agri-Food, involving people within the agri-food supply chain aiming to reduce food waste and plastic packaging use;

- Construction, involving people within the construction and demolition sector focusing on material recovery;

- Textiles, involving people within the textile and apparel supply chain aiming to facilitate recycling and reuse;

- Plastics, involving people within the distribution chains (retailers and wholesalers) and those involved in packaging management and/or production aiming to reduce waste and replace plastic with alternative materials.

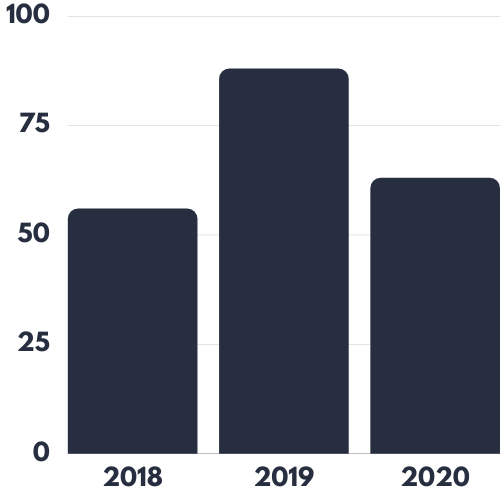

According to a survey conducted by Coldiretti, in Italy, the turnover of the Circular Economy reached 88 billion euros in 2019, with a decrease of 20.5% in 2020 (70 billion euros). In 2020, there were 143,000 companies involved in the Circular Economy, with 132,000 engaged in repair and reuse activities and 11,000 in recycling. In Europe, the market reached a total value of 147 billion euros in 2019. This data also highlights that Italy's recycling rate (67%) is higher than the European average (55%).

Finally, like many other market sectors, the Circular Economy sector is cyclical but experiencing strong growth in terms of investments.

Market Risks

The Green Deal represents a push for profitable investments in the sustainability and environmental sectors. In fact, the European Union has implemented advanced policies in this area for several years now. Investing in this direction is certainly not an unwise choice. However, it is still important to consider some risk factors, such as:

- Complexity of administrative and Legal procedures, both at the national and European levels. The regulations governing this field can be diverse and sometimes quite intricate. It often becomes challenging for businesses to comply with and seize the green market opportunities. Additionally, bureaucratic slowness tends to further slow down these practices. This factor is highlighted by 38% of Italian SMEs;

- Long-term investment (Patient Capital), the Circular Economy is not for "get-rich-quick" investors because it is a trend that develops over the years. Therefore, profits are neither easy nor achievable in the short term;

- PEST events, the Circular Economy sector is particularly correlated and dependent on political and technological leverage, which can influence its trends and results over time.

Market Values

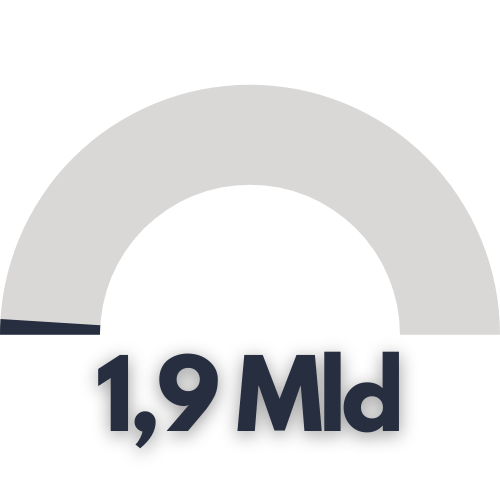

Investments in Recycling, Reuse and Repair (in €, 2020)

Revenue Trends (in Billion of €)

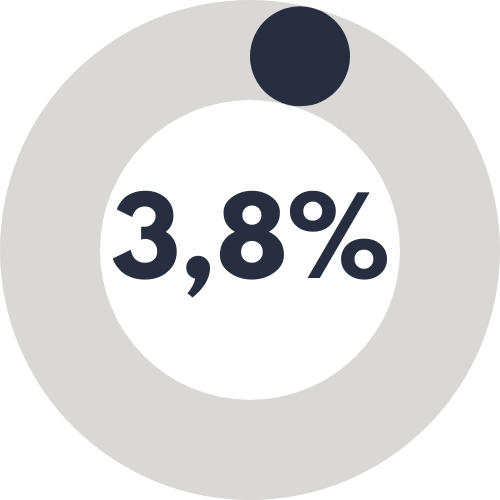

Contribution % to GDP (Italy, 2020)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.