Technology - ICT

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Technology - ICT Sector

Every day, we witness significant and rapid transformations in the world around us. Among the factors that greatly influence these changes, we find Technological Innovation, Globalisation and Telecommunication Networks. Technology plays a primary role in our daily lives, saving us time, assisting us in various activities, enhancing our intellectual abilities and facilitating processes and actions. For these and other reasons, WeInvest has dedicated a Sectorial Thematic Club Deal to Technology - ICT.

There are numerous investment opportunities within this sector and many companies are currently involved in designing and producing new technologies. Today, international analysts believe that investing in categories such as Robotics, Artificial Intelligence, Cybersecurity, etc., offers excellent profit potential.

The main categories within the ICT sector include hardware, software and digital communications. These three sectors are widely employed in various social, commercial and economic contexts worldwide. It is precisely their cross-sectoral nature that generates significant investment opportunities. However, it is important to note that with numerous technology companies available for investment, there is a risk of missing out on such opportunities by solely focusing on Big Companies.

Sector Characteristics

Business Model

Technology - ICT: a market sector composed of companies specialised in information, communication and technology, engaged in activities such as research, development, planning, consulting, production and distribution of technology-based goods and services. Within this broad sector, there are companies characterised by different Business Model:

- Telecommunication Companies, that work on cable television and telephone systems, radio networks, satellite systems and mobile phone networks;

- Tech Company, entities that create, produce and develop new technologies, including both hardware and software, such as computers, servers, machinery, robots, physical products, as well as applications, artificial intelligence, digital platforms, etc.;

- AgriTech, the application and integration of cutting-edge technologies in production and control processes in the agri-food sector;

- Smart Factory, the use of various digital technologies to dynamically coordinate people, processes and other aspects of the surrounding environment, such as equipment or spare parts;

- BioTech, the application of technology in biology, triggering processes that use biological systems and living organisms to produce new or modified products or processes;

- MedTech, medical technology that involves devices for healthcare systems, including diagnosis, patient care, treatment and improving a person's health;

- FinTech, financial technology which refers to financial innovation made possible by technological development, resulting in new business models, processes and/or products. Examples include mobile payment applications, cryptocurrencies, open APIs, crowdfunding, etc.;

- Insurtech, technology-driven innovation in the insurance industry, impacting traditional business models through phenomena such as the sharing economy, blockchain, cybersecurity, IoT and AI;

- InfraTech, the integration of materials, machinery and digital technologies that impact the lifecycle of infrastructures (urban and non-urban). It refers to any technology that influences the development, distribution and operation of these infrastructures.

Status

Deciding to invest in the Technology - ICT sector is an effective way to diversify one's investment portfolio, as technology is now present in all market sectors. All the next-generation technologies such as Cloud Computing, IoT, AI, etc., are part of today's technological revolution. There are multiple reasons to consider investing in the technology field, including capital preservation or growth, fostering innovative research, cost-saving opportunities, etc.

In general, this sector is cyclical and experiencing strong growth (greater than other markets). As mentioned earlier, the sector is closely interconnected with other market areas, capable of influencing them and giving rise to new specialisations (such as: FinTech, AgriTech, MedTech, BioTech, etc.).

Market Risks

Like any other business opportunity, investments in technology and/or ICT companies can also involve risks, among the most common ones:

- Rapid and continuous Industry change, which can be due to the removal or replacement of certain products from the market with the introduction of new ones (think of the speed at which new smartphone models are released);

- Decline in the project and/or company being invested in, considering that technology companies and startups may fail to establish themselves in the market or maintain consistent success over time. This would result in a decrease in their value, partly due to rapid technological obsolescence;

- Difficulty in assessing technological risk.

Market Trends

The Technology - ICT sector, is strongly driven by constant and rapid evolution, primarily driven by the phenomenon of Digital Transformation, which brings along the major market trends that currently present significant investment opportunities. Among these trends are:

- Virtual Reality, which refers to the simulation of a real situation with which a human subject can interact using technologies such as goggles or headsets that display scenes and reproduce sounds and gloves (data gloves) equipped with sensors that simulate movements;

- Cybersecurity, a field related to computer security where tools and technologies aim to protect computer systems from external attacks;

- Cloud Services, which are resources available and delivered over the Internet; providers offer these services to subscribers, allowing customers to leverage powerful computing resources without having to purchase hardware and software;

- 3D Printing, a form of additive manufacturing for creating three-dimensional objects based on a three-dimensional model. The innovation of desktop 3D printing now allows businesses to speed up their production processes and make them more cost-effective by creating equipment, fixtures, gears, etc. that can be used for a wide range of applications;

- AI (Artificial Intelligence), referring to the science and engineering of creating intelligent machines that can imitate the decision-making and problem-solving abilities of the human mind using computers;

- Blockchain, a decentralised ledger of shared data that ensures secure sharing of data among a selected collective group of participants, providing data integrity through a single trusted source, eliminating duplication and increasing security;

- 5G Technology, representing the fifth generation of cellular technology designed to increase speed, reduce latency and improve the flexibility of wireless services.

Market Values

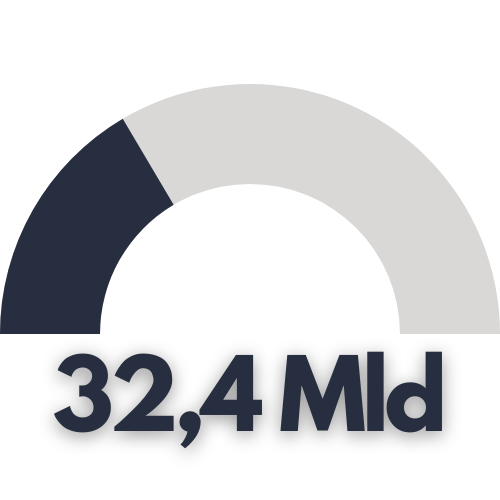

ICT Investments (in €, 2022)

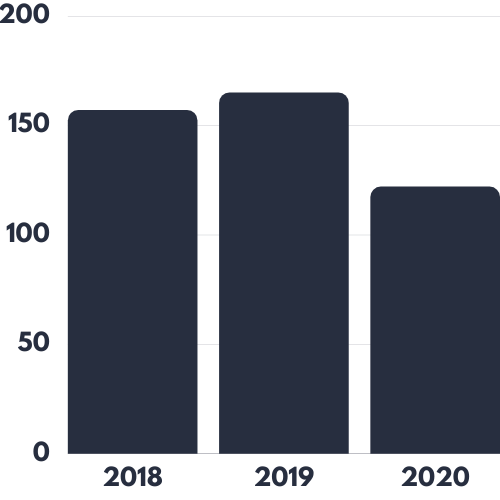

Revenue Trends (in Billion of €)

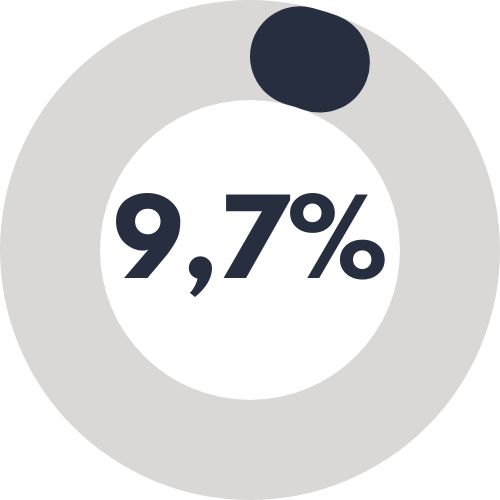

Contribution % to GDP (Italy, 2020)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.