Energy

Sectorial Thematic Club Deal

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

- 4 piani fuori terra, con una superficie totale di circa 2.000 mq

The Energy Sector

Considered conservative, difficult and slow to adapt to different market forces, is facing significant changes and ongoing challenges in recent years, with a focus on Environmental Sustainability and consumer expectations. This has led to an increasing push towards Renewable Energy sources, which represent important and solid investment choices, ranging from solar power to hydroelectric and wind power. At WeInvest, we also support Green Investing, which is why we have chosen to dedicate a Club Deal to the Energy sector.

Speaking of the energy industry, it can be understood as a broad term encompassing companies of various nature involved in different activities along the production chain of this market. We find companies in the oil and gas industry, companies engaged in the production and distribution of other fuels and various equipment and companies involved in exploration, commercialisation and distribution of energy.

Sector Characteristics

Energy Models

Energy is a market sector in which companies in the energy equipment and services industry, as well as the oil, gas and fuel consumption industry, operate. These companies convert various types of fuel for a variety of purposes, including residential, commercial, transportation and industrial uses. The main sources of energy include:

- Oil, which is the primary energy source in the contemporary world, has the nickname "black gold." It is a mixture of hydrocarbons found in liquid form in reservoirs on the Earth's crust, resulting from the decomposition of marine organisms and vegetation. The main extraction areas are located in the Middle East;

- Coal, which is primarily used for thermal or electric power generation. This energy resource has a more significant environmental impact compared to other energy sources due to the air pollution generated during combustion. It is also a finite resource;

- Natural Gas, fossil fuel formed underground through the anaerobic decomposition of organic matter. It is commonly found in nature as fossil fuel and is predominantly referred to as methane in everyday use;

- Biomass, a clean energy source that reduces dependence on fossil fuels. It involves the use of organic waste materials and is a zero-emission renewable energy source;

- Nuclear, also known as atomic energy, is obtained from nuclear reactions and radioactive decay, which release electromagnetic and kinetic energy. It is harnessed through various nuclear technologies and holds particular significance in the energy sector;

- Hydropower, a renewable, clean and sustainable form of energy derived from water. It utilises the movement of large bodies of water driven by gravity or channeled through dams, locks, canals and turbines. It is considered the energy of the future;

- Wind Energy, derived from wind and atmospheric events, also known as the kinetic energy of moving air masses. It serves as a substitute for fossil fuel combustion, is a renewable and clean energy source, and supports the economy;

- Geothermal, energy generated using heat from geological sources in the subsurface. It is an alternative and renewable form of energy that offers stability and can be obtained consistently with a smaller land footprint compared to other renewable energy sources;

- Solar, an energy source associated with solar radiation, commonly utilised by autotrophic organisms. It is harnessed through photovoltaic panels or solar thermal collectors and used for electricity and heat production. It is an inexhaustible, universally available, and 100% clean energy source.

Status

The global energy sector has experienced a surge in investments over the past decade. The true protagonists of this phenomenon are renewable energy sources, which offer high returns and low volatility, particularly in solar and wind energy investments. This growth is driven by the increasing importance of sustainability, which has become central in today's political debates. Thanks to technological advancements and the conversion of certain production cycles, it now costs less to invest in renewable energy production than in traditional sources like coal, for example. In general, the sector is characterised as cyclical, stable and long-lasting. Investing in energy today allows for portfolio diversification, providing investors with a certain level of security. There are various ways to invest in green energy, such as purchasing renewable energy, becoming electricity producers, or investing in solar and/or hydropower, with a focus on assets like Agrivoltaics, Agri-Solar, and more.

Market Risks

Like any other market sector, the energy sector involves risks that need to be taken into account before deciding where to invest. This sector is characterised by the volatility of energy prices (such as oil, natural gas, coal, etc.) and the risk of price declines, which vary among different energy sources.

Furthermore, contextual factors of a PEST nature (political, economic, social and technological) also influence the sector. For example:

- the Russian invasion of Ukraine which has led to limitations on investment portfolios in the Russian market, significantly reducing or, in some cases, completely eliminating coverage for coal generation assets;

- the capacity of insurance volumes for energy risks, which amounted to $3.5 billion in 2022, of which realistically only $1.5 billion is usable;

- increased credit ratings, due to rising losses across almost all types of risk;

- rising inflation

- high transaction costs in the energy sector

- increasing occurrences of extreme weather events

These factors have had a negative impact on the energy sector, starting as early as 2019-2020, leading to a global crisis that is expected to persist in the coming years.

Market Trends

- Liberalisation process of the electricity sector, which significantly impacts consumer choice. Consumers will need to be informed about energy prices and operators will have the freedom to set their own market prices;

- Increased use of green energy sources, driven primarily by the energy transition efforts of companies operating in various market sectors. There is a growing emphasis on shifting towards renewable and green energy sources;

- Investor interest in renewable and green energy, these investments are considered safer and more long-lasting over time and they also allow investors to diversify their investment portfolios.

Market Values

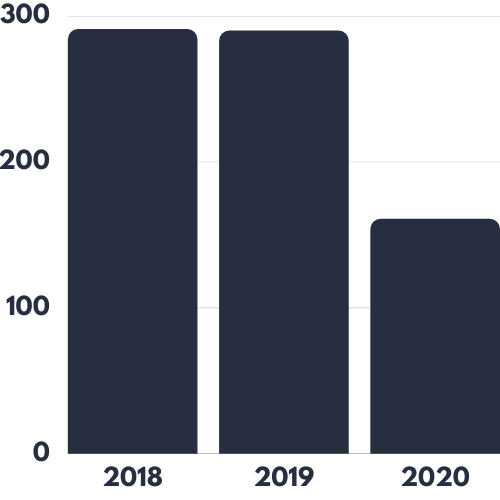

Renewable Energy Investments (in €, 2019)

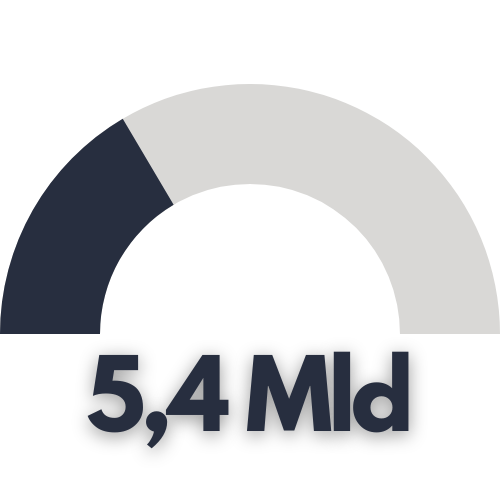

Revenue Trends (in Billion of €)

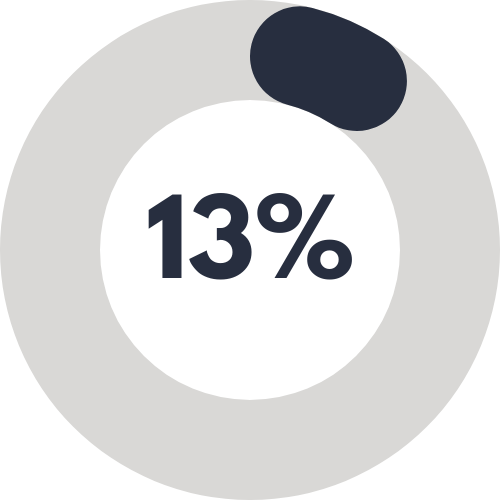

Contribution % to GDP (Italy, 2020)

Get Value to your Investments for an Innovative, Real and Sustainable Economy & Finance

Improve your ability to conclude deals, with a clear reduction in closing times and maximising the profitability of each Investment, never losing sight of social ethics and sustainability: join the Network Club Deal WeInvest.